[ad_1]

KEY

TAKEAWAYS

- Asian inventory markets exhibiting robust relative tendencies

- India, Mexico, and Brazil are nostril diving

- The US nonetheless beats Europe

The worldwide inventory market is a giant place and it extends far past the borders of america.

Whereas the US market is undeniably the biggest and sometimes units the tempo for others, it is revealing to step again and take into account the worldwide scene often. This broader perspective can alert buyers to vital shifts in inventory market rotations worldwide, notably when the US market has marched off by itself.

Present Worldwide Rotations

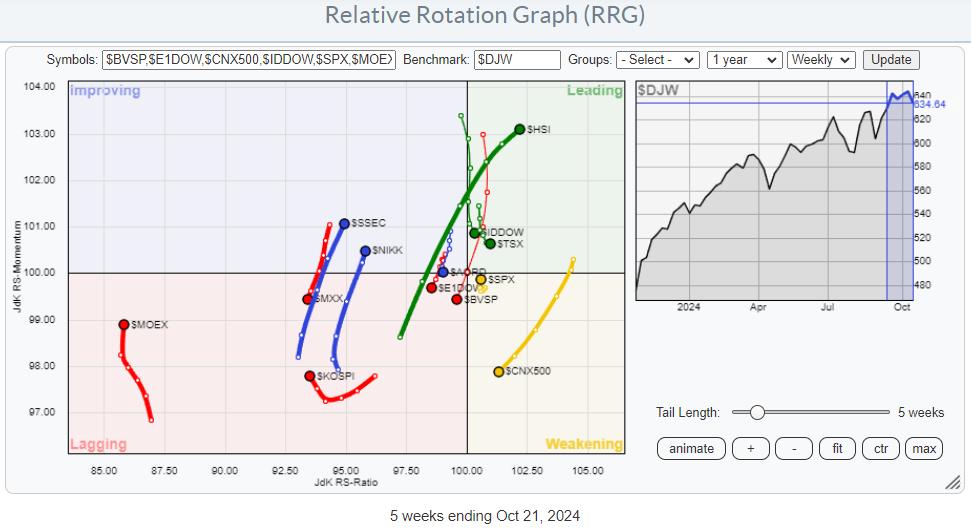

The Relative Rotation Graph (RRG) for worldwide markets above plots a number of worldwide inventory market indices and benchmarks them in opposition to the Dow Jones World Index ($DJW).

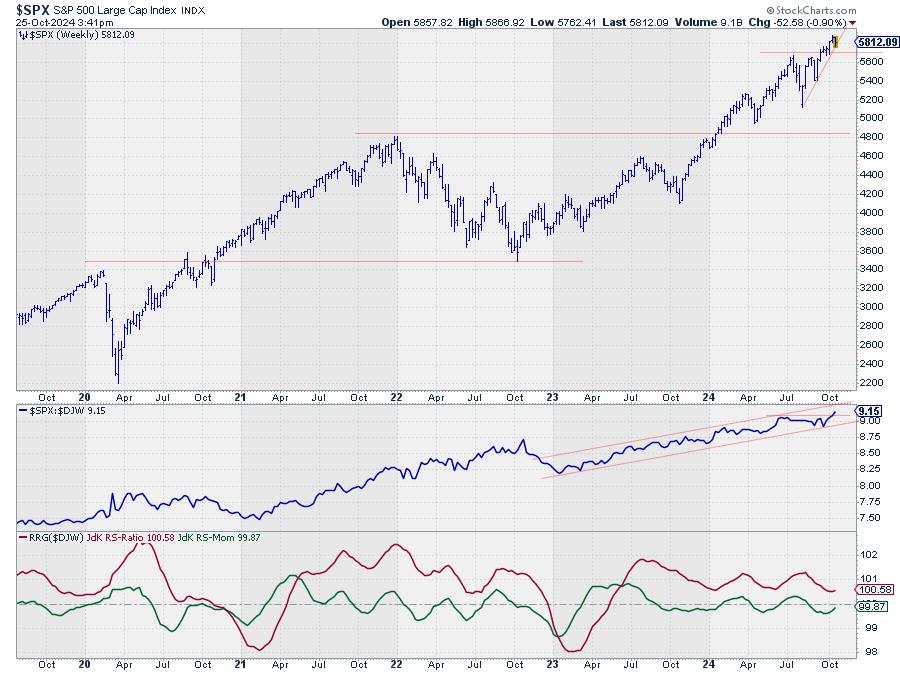

The S&P 500 (greenback SPX) is positioned very near the middle of the chart, hugging the benchmark. This proximity is anticipated, provided that the US constitutes a hefty portion of the Dow Jones World Index.

Nonetheless, the S&P 500 can be depicted with a brief tail throughout the weakening quadrant, indicating a renewed up-move throughout the already rising relative development.

Asian Markets Are Robust

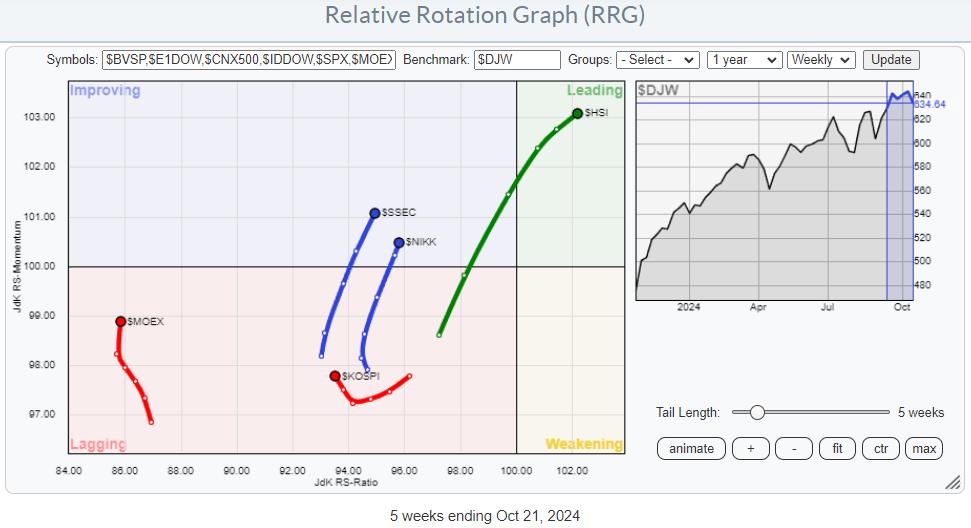

Shifting our focus from the US, we observe a number of well-defined and strong relative tendencies in different markets. The Dangle Seng Index ($HSI) in Hong Kong stands out with its tail transferring from the lagging quadrant by way of enhancing and into the main quadrant over the past 5 weeks.

That is the longest tail on the RRG, suggesting a strong transfer with a optimistic RRG heading and the best RS momentum and ratio readings.

Different markets exhibiting optimistic tendencies embrace China ($SSEC) and Japan ($NIKK), each of which have transitioned from the lagging to the enhancing quadrant. This shift signifies a relative energy and momentum pickup, hinting at seemingly outperformance within the coming weeks.

Conversely, the Russian ($MOEX) and Korean ($KOSPI) inventory market indices are selecting up relative momentum however stay throughout the lagging quadrant, persevering with to underperform.

The place is the Cash Flowing?

If we assume that international inventory market cash migrates to probably the most promising areas, we’ll discover outflows from sure markets.

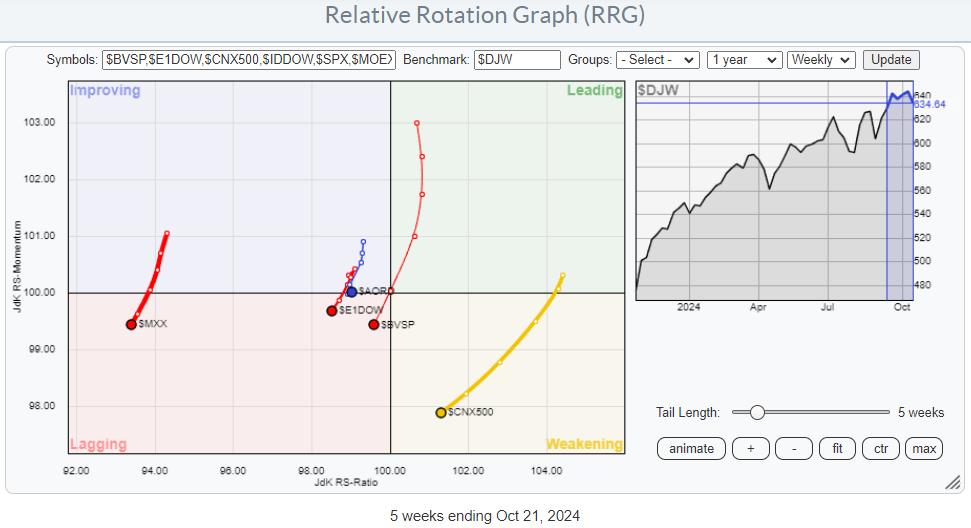

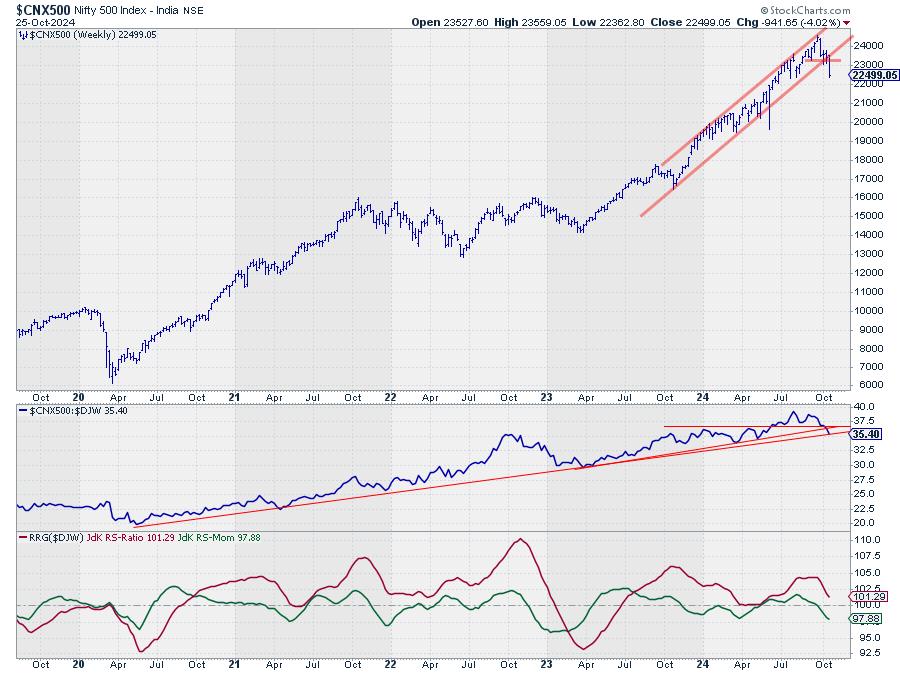

As an illustration, India’s CNX 500 has seen its tail transfer from the main quadrant by way of weakening. It’s quickly approaching the lagging quadrant, signaling a shift to underperformance, notably in opposition to the Asian markets and the S&P 500.

A number of markets, together with the Australian All Ordinaries Index ($AORD), the DJ Europe index ($E1DOW), the Brazilian Bovespa index ($BVSP), and the Mexican Bolsa Index ($MXX) exhibit unfavourable headings nearer to the benchmark. The Brazilian market, specifically, reveals a protracted tail crossing into the lagging quadrant. On the identical time, the Mexican Bolsa accomplished a rotation of lagging-improving-lagging at very low RS-ratio ranges. This makes it one of many weaker and extra harmful markets from a relative perspective.

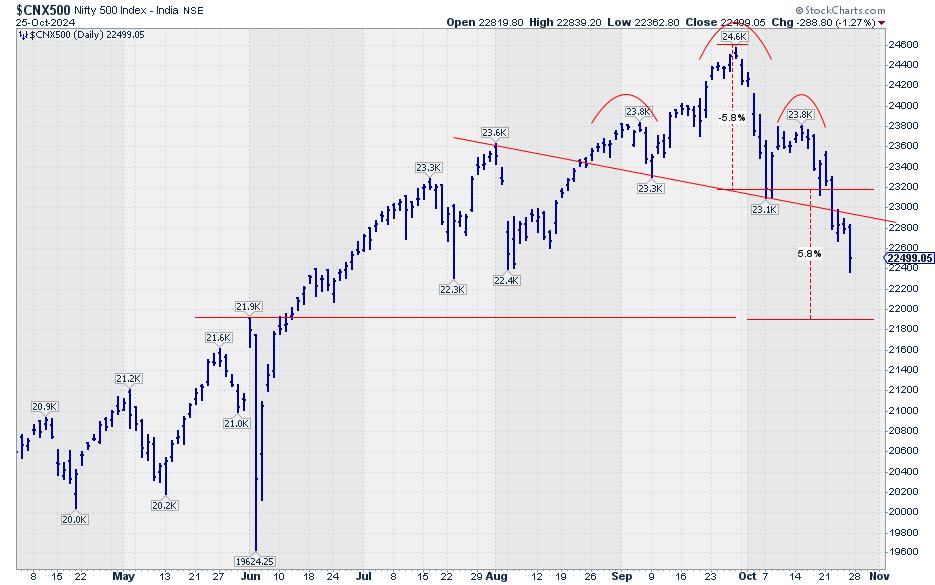

Dangle Seng Index vs. Indian CNX 500

The Dangle Seng Index and the Indian CNX 500 current contrasting tendencies.

After a protracted decline, the $HSI has fashioned a broad buying and selling vary and is at present testing a major resistance stage. A break above this resistance may sign substantial upside potential, with relative energy indicators suggesting a bottoming out and a possible shift in development.

In distinction, the Nifty 500 index in India has accomplished a topish formation, with relative energy trending downward. This factors to additional underperformance and a unfavourable value trajectory for the Indian market.

Zooming in on the every day chart of the Nifty 500 reveals that an H&S high formation has simply accomplished, signalling weak spot not solely from a relative perspective but additionally by way of value.

S&P 500 vs. European Markets

The S&P 500 and European markets are additionally transferring in reverse instructions.

The Dow Jones Europe index has encountered resistance and reveals a breakdown in relative energy versus the worldwide benchmark, confirming a relative downtrend.

In the meantime, the S&P 500 has damaged to new highs in relative energy, affirming its relative uptrend.

Key Takeaways

From a global perspective, the Dangle Seng index and the S&P 500 exhibit optimistic rotations, whereas the Nifty 500 and European markets are on a unfavourable trajectory.

It is vital to notice that the energy of the S&P 500 doesn’t assure its continued rise; it merely signifies that, at current, it’s outperforming many different markets.

By analyzing relative strengths and rotations utilizing Relative Rotation Graphs, buyers can acquire insights into the place the markets could also be heading vis-a-vis one another and make extra knowledgeable selections.

#StayAlert and have a fantastic weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to answer every message, however I’ll actually learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Drive in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra

[ad_2]