[ad_1]

The present trajectory of Bitcoin (BTC) costs might push it to the $100,000 mark throughout the subsequent 90 days, whatever the outcomes of the U.S. presidential election.

Bitcoin At $100,000 By February 2025?

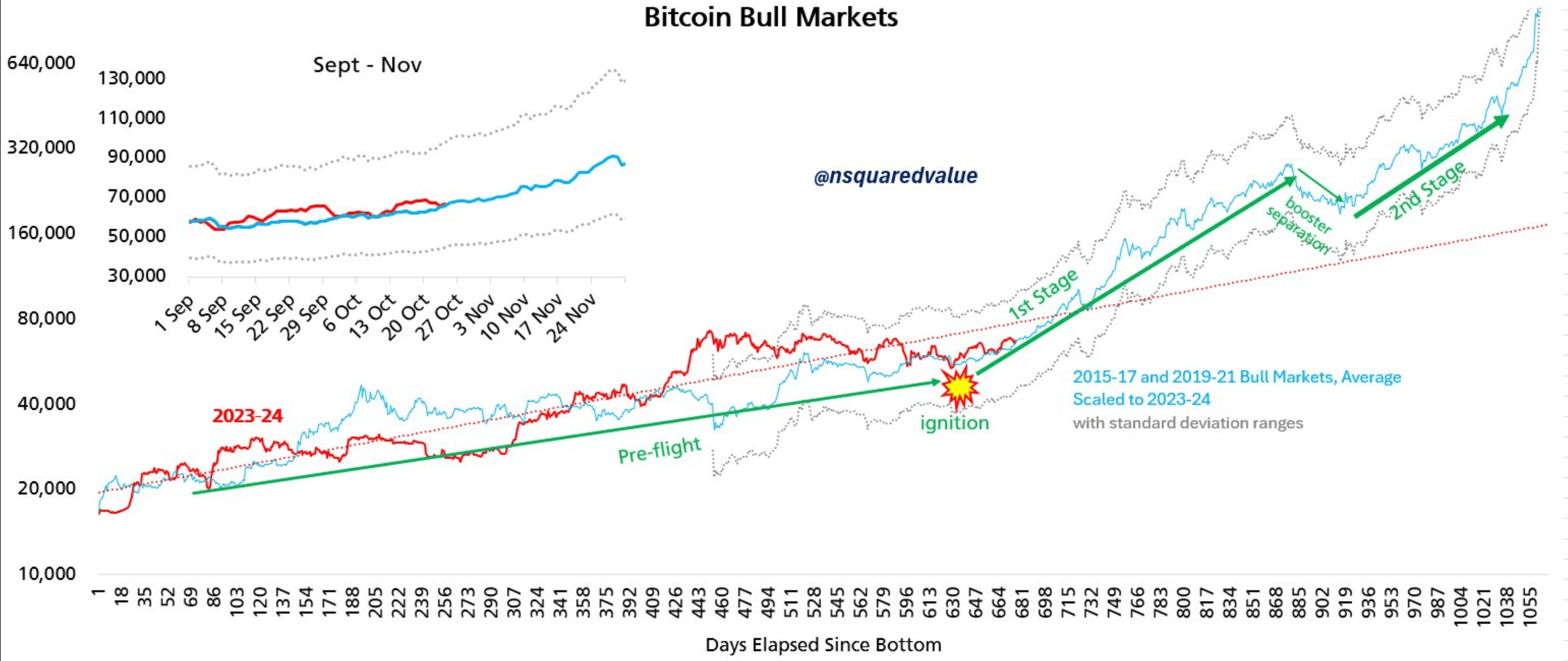

Crypto analyst Timothy Peterson means that BTC’s present worth motion will not be considerably completely different from earlier developments, elevating questions in regards to the “diminishing marginal returns” principle.

Associated Studying

From an investor’s perspective, Bitcoin’s diminishing marginal returns principle implies that every halving cycle results in smaller successive worth good points, because the digital asset’s whole market cap matures and its provide shocks have a minimal impact on driving up demand.

This implies that whereas BTC might proceed to develop, the extraordinary returns seen in early cycles might lower over time. Nevertheless, Peterson’s evaluation seems to dismiss this principle.

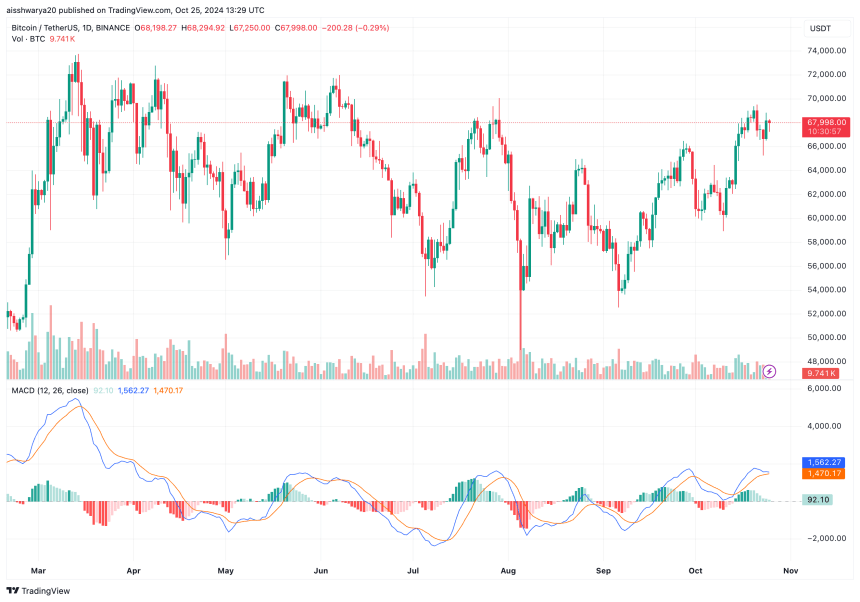

To recall, BTC made its all-time excessive (ATH) of $73,737 in March 2024. Since then, the main cryptocurrency has been consolidating for nearly eight months in a large worth vary, reaching as little as $54,000. On the time of writing, BTC trades at $67,998, about 10% decrease than its ATH.

Peterson argues that BTC’s motion simply above the pink trendline would put the digital asset at $100,000 inside 90 days. The analyst added that such a transfer will probably be “utterly inside cause.” He added:

A conservative state of affairs places bitcoin at $100k round February. I believe this occurs whatever the US election end result.

Moreover, the analyst instructed that in line with different data-driven metrics he’s monitoring, BTC will not be overpriced at its present market valuation, and the likelihood of a drop beneath $60,000 is more and more unlikely.

Focus On BTC Yr-Finish Value Predictions

Whereas Peterson envisions BTC nearing $100,000 inside three months, different analysts and trade insiders have various expectations.

Associated Studying

As an illustration, choices market merchants count on BTC to interrupt via its earlier ATH by November finish, irrespective of who turns into the following US president.

Equally, in a latest consumer memo, Bitwise CIO Matt Hougan outlined a number of components that might power BTC to “melt-up” to $80,000 in This autumn 2024.

These components embody the potential victory of Republican candidate Donald Trump, further rate of interest cuts by the U.S. Federal Reserve (Fed), and an prolonged interval freed from main detrimental developments within the crypto sector.

Apart from the aforementioned components, the optimism towards a year-end BTC rally can also be fueled by rising retail demand for the premier digital asset.

Latest evaluation by CryptoQuant highlighted that Bitcoin transactions price lower than $10,000 are on an uptrend, indicating renewed retail demand because the market step by step pivots from risk-off to risk-on mode. BTC trades at $67,998 on the day by day chart at press time, up 1.1% previously 24 hours.

Featured picture from Unsplash, Charts from X and Tradingview.com

[ad_2]