[ad_1]

The chance to reward ratio—generally often called the danger/return ratio—displays the anticipated yield an investor could earn for every greenback they put at stake in an funding. Many buyers use the danger to reward ratio chart to judge the potential returns of an funding in relation to the extent of threat they have to undertake to realize these returns. A decrease threat to reward ratio is usually extra interesting, because it signifies much less threat for the same potential achieve .In abstract, the danger to reward ratio chart helps buyers make knowledgeable choices by evaluating potential returns in opposition to the related dangers.

As an example: Think about an funding alternative with a risk-reward ratio of 1:5. Which means that an investor is ready to threat $1, with the potential to realize $5 in return .However, think about an funding with a risk-reward ratio of 1:2. On this case, the investor anticipates placing in $1, aiming for a doable return of $2 on their funding. This illustrates how totally different ratios can point out various ranges of threat and potential reward related to an funding.

Merchants typically undertake a savvy technique to decide on their trades correctly. This highly effective ratio emerges from the calculation of what they stand to lose if an asset’s value takes an surprising flip (the danger) in comparison with the potential revenue they purpose to pocket once they shut the deal (the reward).

Do you know that profitable merchants typically use this ratio to rework their mindset about risk-taking? By turning their consideration towards potential rewards, they will higher handle their worry of losses! By harnessing this insightful method, merchants can navigate the tumultuous waters of the market with confidence. They’ll successfully stability the scales of threat and reward, maximizing their possibilities of putting it wealthy! Plus, many seasoned buyers suggest setting a goal risk-reward ratio earlier than coming into a commerce—form of like having a treasure map guiding them to income! Understanding this significant ratio equips them to sharpen their methods and seize profitable alternatives as they come up. In any case, on the planet of buying and selling, data and preparation can imply the distinction between merely surviving and thriving!

Using threat/reward ratios

Using threat/reward ratios successfully necessitates understanding what constitutes a positive threat/reward ratio. A 1:1 ratio signifies that you’re risking the identical quantity of capital in case you are incorrect a few commerce as you’ll probably earn in case you are right. This parallels the identical threat/reward ratio present in on line casino video games equivalent to roulette, making it primarily of venture. The vast majority of seasoned merchants purpose for a threat/reward ratio of 1:3 or extra.

The Dynamics of the Threat/Reward Ratio

In lots of cases, market analysts conclude that the perfect threat to reward ratio chart for investments is roughly1:3. This means that for each one unit of further threat undertaken, there’s an expectation of three items of return.Buyers can successfully handle their threat to reward ratio chart by using stop-loss orders and monetary devices equivalent to put choices. This method aids them in reaching their monetary targets whereas minimizing pointless dangers.By fastidiously analyzing the danger to reward ratio chart, buyers can achieve perception into potential outcomes and make knowledgeable choices. Total, specializing in the danger to reward ratio chart empowers buyers to navigate the market whereas enhancing their potential for achievement.

Shadows of Alternative

Within the ever-evolving panorama of buying and selling, greedy the interaction between threat and reward is essential for reaching success. Buyers repeatedly search efficient methods that align with their monetary aspirations. Among the many varied metrics utilized in inventory buying and selling, the danger to reward ratio chart emerges as a significant instrument. This ratio allows merchants to judge potential returns in relation to their threat urge for food, guiding their decision-making processes throughout varied buying and selling kinds. By delving into the intricacies of this important metric, merchants can refine their methods, scale back losses, and improve their funding journeys, all whereas leveraging insights from the danger to reward ratio chart.

Threat Dynamics

The chance/reward ratio is regularly utilized as a benchmark when buying and selling particular person shares.

Various Methods

The optimum threat/reward ratio varies considerably relying on totally different buying and selling methods.

Private Discoveries

Many buyers typically have a pre-established threat/reward ratio for his or her investments, and a few depend on trial-and-error strategies to search out the perfect ratio for his or her particular buying and selling methods.

Elements of the Ratio

A ratio is a relationship or comparability between two numbers or comparable portions, sometimes expressed as a fraction.###

Elements of a Ratio

1. Antecedent: That is the primary time period of the ratio. In fraction type, the antecedent is the highest quantity or numerator.

For instance, within the ratio (3:4), the quantity (3) is the antecedent.

2. Consequen: That is the second time period of the ratio.

– In fraction type, the ensuing is the underside quantity or denominator. – Within the instance (3:4), the quantity (4) is the ensuing.

Instance:

If we think about the ratio of apples to oranges as (2:3): Which means that for each (2) apples, there are (3) oranges.

Sorts of Ratios:

– Easy Ratios: Ratios that may be simplified.

– Complicated Ratios: Ratios that contain varied eventualities, such because the ratio of space to perimeter.

Idea of Threat and Reward Commerce-off

Based mostly on the precept of risk-return tradeoff, if an investor is ready to tolerate a larger probability of losses, their invested capital has the potential to yield larger returns. To evaluate funding threat, buyers make the most of metrics equivalent to alpha, beta, and Sharpe ratios.

Calculating Threat-Return

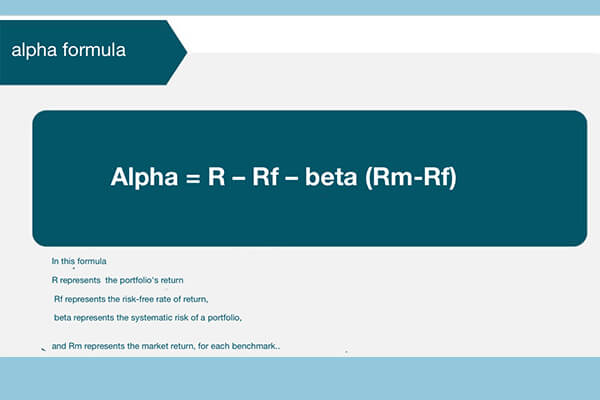

Alpha Ratio

– The alpha ratio is a measure used to evaluate the surplus return of an funding in comparison with a benchmark index.

– It signifies whether or not an funding has successfully capitalized on its threat to realize returns above what the market would predict.

– A optimistic alpha worth signifies outperformance relative to the benchmark, whereas a unfavorable worth signifies underperformance.

Beta Ratio

– The beta ratio displays the volatility of a inventory relative to the general market, generally measured in opposition to the S&P500 index.

– To calculate beta, you divide the variance (which measures the market’s fluctuations relative to its common) by the covariance (which signifies the correlation between the inventory’s return and the market’s return).

– A beta worth larger than 1 signifies greater volatility in comparison with the market, whereas a price lower than 1 signifies decrease volatility. This ratio will help buyers regulate their funding methods accordingly.

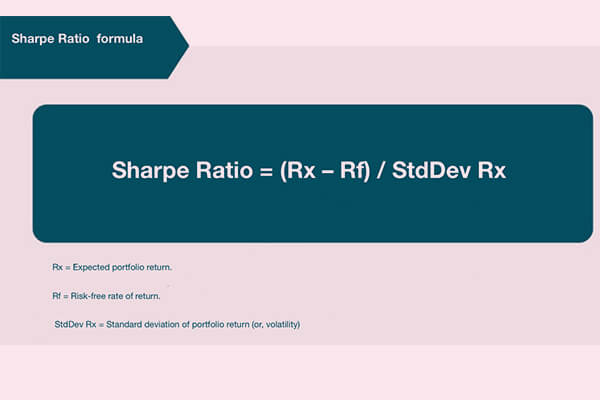

Sharpe Ratio

– The Sharpe ratio is used to judge the effectivity of an funding by contemplating its threat.

– This ratio examines whether or not the return generated from an funding is justified in comparison with the danger related to it.

– The method for calculating the Sharpe ratio is: (Precise Return – Threat-Free Return) / Customary Deviation.- The next Sharpe ratio signifies that an investor has skilled greater returns relative to the danger taken, making it seem extra engaging.You probably have any additional questions or for those who want extra detailed explanations, be happy to ask!

Components Influencing the Threat to Reward Ratio

A number of components have an effect on the danger to reward ratio chart foreign exchange. These components embody broad financial circumstances like authorities insurance policies, rates of interest, and varied social and financial circumstances that might adversely affect market costs.Moreover, unsystematic threat refers to the opportunity of loss occurring at a extra localized financial degree, which can be mirrored within the threat to reward ratio chart foreign exchange. Understanding these influences is important for buyers aiming to make knowledgeable choices primarily based on the danger to reward ratio chart foreign exchange. In abstract, each macroeconomic and localized components play a major position in shaping the danger to reward ratio.

The Premium Pattern Sniper Professional Indicator is a complicated device for buying and selling success, constructed on the Pattern Sniper basis. It makes use of trendy algorithms to research value actions and options like multi-timeframe evaluation, volatility indicators, and customizable alerts. This indicator helps merchants make fast and knowledgeable choices, appropriate for each newbies and skilled merchants. With the Premium Pattern Sniper Professional, you possibly can rework your method to evaluation and revenue technology in monetary markets!

[ad_2]