[ad_1]

It’s clear that Ethereum has turn out to be too diffuse with its layer 2s, particularly when held towards the lean, imply “Eth Killer” Solana. However is that this an indication Ethereum will lag on this cycle, or will it rise as a prime contender when the mud settles?

Ethereum has confronted a storm of skepticism currently, with everybody from Bitcoin Maxis to Memecoin merchants taking photographs, whereas Solana is using a recent wave of momentum. Right here’s what you need to know of which would be the higher hodl this cycle.

The Ethereum Wrestle Vs. Solana

Nonetheless the heavyweight champ within the sensible contract enviornment, Ethereum finds itself in troubled waters. Its worth towards Bitcoin has sunk to a degree final seen over three years in the past, reigniting investor nervousness. The blame is liquidity pouring Ethereum into different sensible contract platforms like Solana.

“Ethereum stays the main sensible contract platform dedicated to true decentralization, with important institutional adoption and developer exercise,” emphasised Eric Connor, one among Ethereum’s core builders, as he defended the blockchain from its critics.

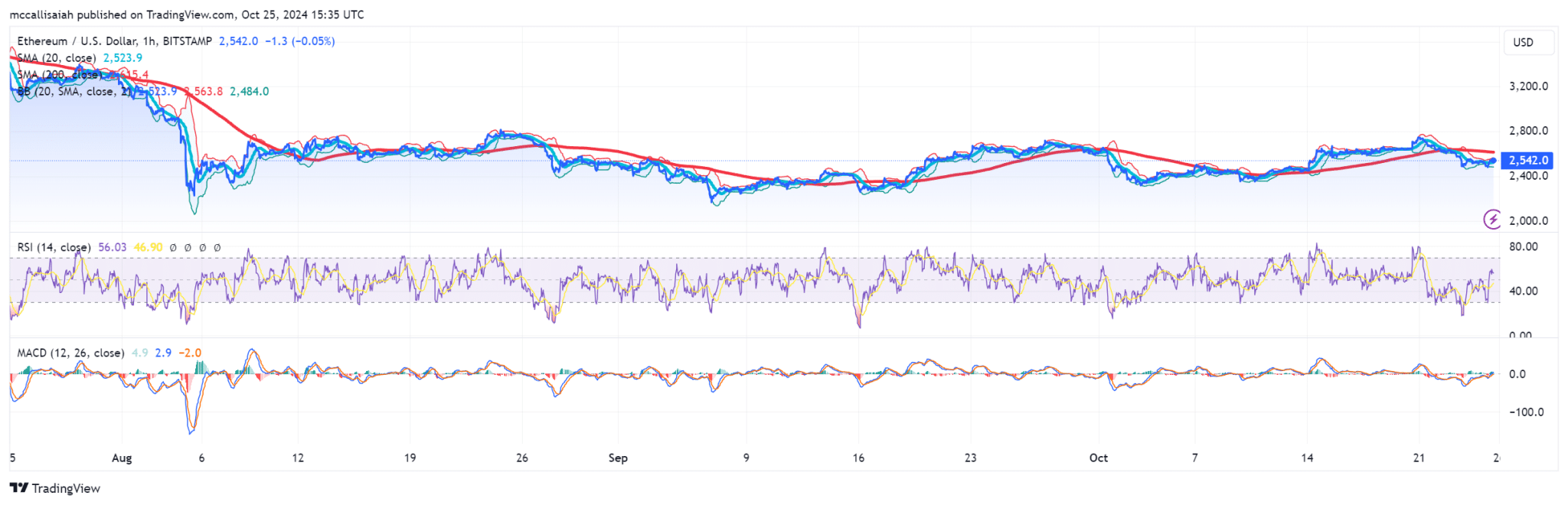

Ethereum finds itself in a bind, because of the emergence of layer-2 options and rival platforms draining its liquidity and customers. This has stalled ETH’s momentum, dragging its value under the $2,500 mark whereas Bitcoin strides forward in restoration. So is Ethereum screwed? Sure and no.

On this cycle, DO NOT count on Ethereum to outperform Bitcoin or any trending altcoins like Solana, Sui, and Kaspa.

Nonetheless, Vitalik Buterin and firm have made a guess with the proliferation of L2s that may take years to repay; it gained’t be quick.

Ethereum is in serious trouble

UNI transferring off-chain is barely the ultimate nail within the coffin, all apps are transferring to competing L1s & L2s as a substitute

Collapsing ETH income, UNI was ETH's largest fee-paying buyer!

Now ETH is being left behind, irrelevant & damaged; Ethereum is cooked

… pic.twitter.com/AY55IShcoD

— Justin Bons (@Justin_Bons) October 14, 2024

Ethereum is the spine of what’s finally going to be a completely digital business infrastructure. I get it. Additionally it is essentially the most boring maintain in crypto. It’s not going to the moon; the ETFs solely gradual it down, and so far as strong layer ones go, there may be perhaps common curiosity in it. It’s like mining iron whereas everyone else is mining gold or diamonds.

You retain serious about all of the issues that want iron, and but you’ll by no means be as excited because the fools who rise up each morning, considering it may be the day that adjustments all the pieces.

DISCOVER: These 100X Cryptocurrencies May Change Every little thing for Your Portfolio This Run

The Highway Forward For SOL & ETH

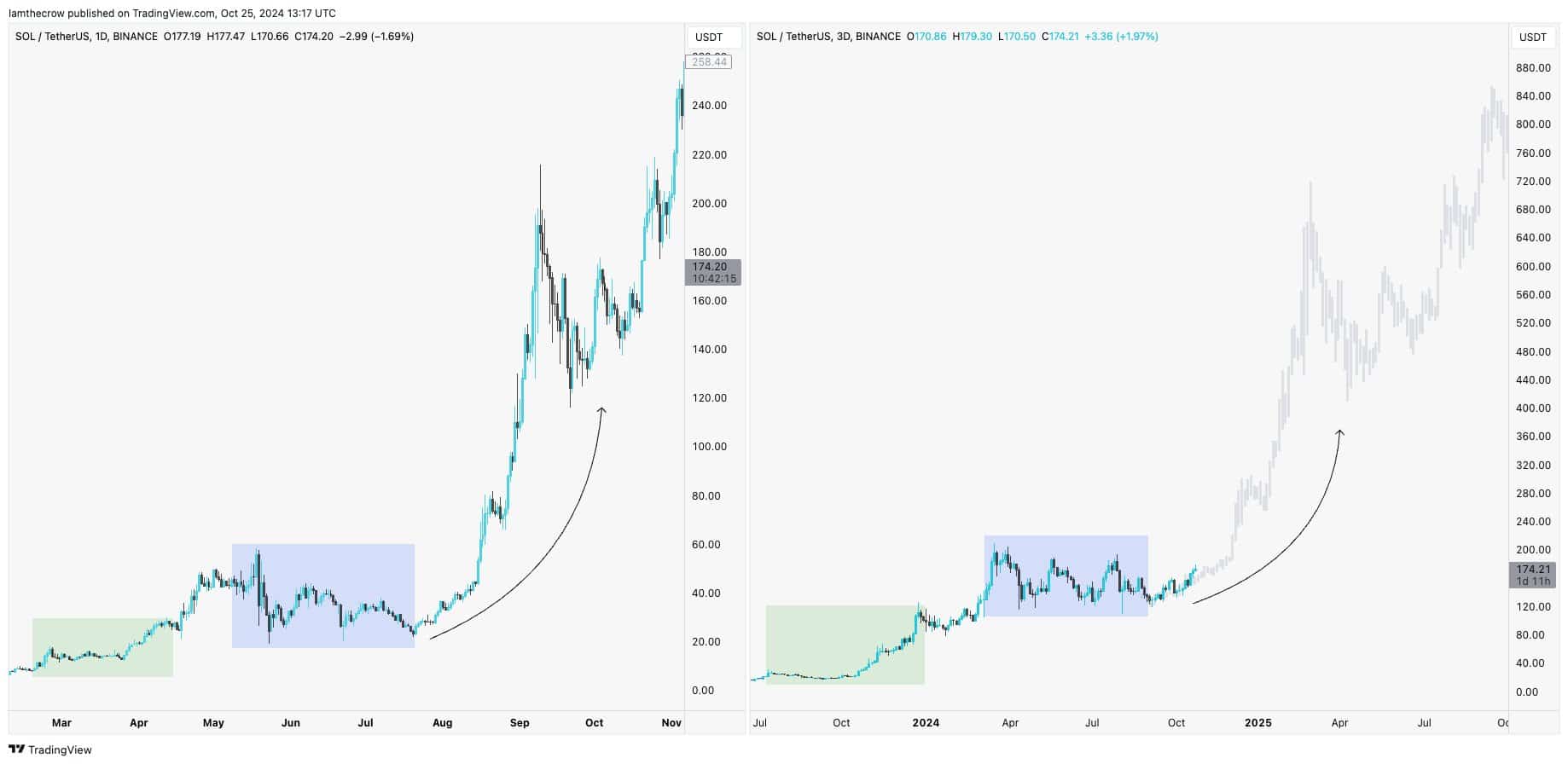

In stark distinction, Solana’s been blazing its personal path, rocketing up 17% this week alone. 99Bitcoin’s analysts level to a lure from Solana’s vibrant ecosystem and dirt-cheap transaction charges. The meme coin frenzy on Solana solely provides gasoline to the fireplace, stealing Ethereum’s thunder.

The journey for Solana isn’t with out hurdles—latest sell-offs by massive gamers like Pump Enjoyable, which bought 40,000 SOL this week, have put stress on its value. Nonetheless, analysts are betting on Solana’s resilience, noting its knack for absorbing new provide and conserving merchants hooked, hinting at a sturdy future forward.

In closing, the Tl;dr is that the FUD towards Ethereum is warranted.

However that is additionally a backside sign for anybody eager for Ethereum. At 99Bitcoins, we typically discover it useful to counter commerce sentiment, and a barrage of negativity can typically be a inform for backside alerts.

As each Ethereum and Solana combat for supremacy and innovation, these holding the purse strings and the code should keep vigilant because the scene evolves.

DISCOVER: Would a Kamala Presidency Actually Kill Crypto? You May Be Shocked

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The put up Why is Capital Rotating From ETH to Solana? Pump.Enjoyable Promote Strain Knocks ETH Basis Promoting Out The Park appeared first on .

[ad_2]